Enterprise Carbon Emission Reduction Account System

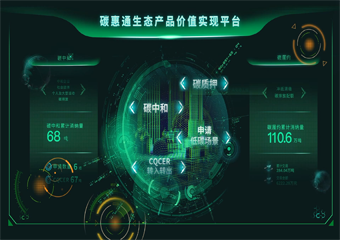

The Enterprise Carbon Emission Reduction Account System is an enterprise carbon emission reduction monitor and management platform supervised by The People's Bank of China Chongqing Municipal Branch and established as well as operated by Chongqing Credit Co., Ltd., which is an important and innovative project to build a green financing reform pilot zone in Chongqing, and an important business and functional part of the "Yangtze River Green Finance" System of The People's Bank of China Chongqing Municipal Branch. Relying on the policy requirements of the "Carbon Emission Reduction Support Tool", the system supports the presentation and accounting of carbon emission reduction information of projects under construction and in operation, and automatically calculates the amount of emission reduction, carbon emission reduction benefits, etc., by means of the platform's baseline pre-set parameters and organic matching, and ultimately generates the projected emission reduction statement and emission reduction report; It supports the comparison and cross-auditing of enterprise system operation data and monitor data through the call, forming a project monitor discrepancy analysis and early warning system, which fully guarantees the reliability of the system monitor results. The system supports enterprises to establish self-declaration, carbon emission reduction and benefit measurement of carbon emission reduction projects through the platform account system; Supporting financial institutions to collect real-time information on carbon emission reduction of enterprises and dynamically carry out corresponding pre-assessment and post-loan management; The system supports regulators to directly use the results of carbon emission reduction benefit measurement for green performance assessment, and organically prevents the phenomenon of "green washing" of green finance. It can effectively reduce the increased costs to enterprises due to the use of third-party human verification, and help to further alleviate the difficulty of back-end management of traditional green financing. The platform is building a "four-in-one" green enterprise-friendly service system that organically integrates monetary policy tools, green finance interest rate advantages, eco-product development, and government financial subsidies.

Your current location:

home

>

Exhibition Hall Online

>

Venue Layout

>

N2

>

Chongqing City Construction lnvestment Corporation

>

Chongqing Credit Co., Ltd.

Your current location:

home

>

Exhibition Hall Online

>

Venue Layout

>

N2

>

Chongqing City Construction lnvestment Corporation

>

Chongqing Credit Co., Ltd.